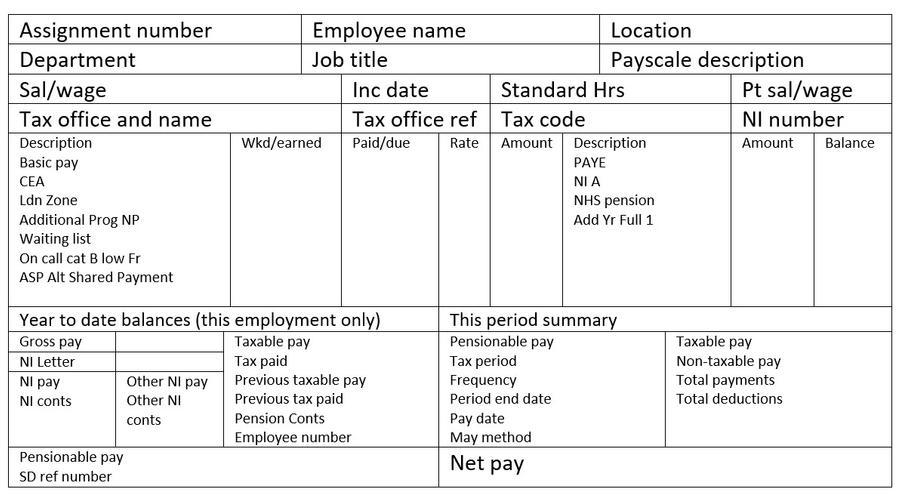

Understanding your payslip

By Caroline Hing

Consultant Orthopaedic Surgeon & Professor of Orthopaedics, St George's University Hospital, London

Why should I check my payslip?

It is important to check your payslip to ensure you are being paid at the right increment and that all the activity is captured correctly (www.bma.org.uk/pay-and-contracts/pay).

Inc date

Your increment date depends when you started in the NHS and at what level. As you progress from one job to the next (e.g. training to consultant level) you need to check you enter at the correct pay scale and increment date as this affects your pension. Also check you are progressing up the pay scales at the correct date and by the correct amount.

What is my salary / wage?

Check you are on the correct pay-scale. You can do this each year by referring to the Pay and Conditions circular which is published each year around August which informs employers of the pay arrangements from 1st April of that year covered by the national medical terms and conditions (www.nhsemployers.org/articles/pay-and-conditions-circulars-medical-and-dental-staff).

If your pay has gone up due to an increment or pay increase it is usually paid in areas in the September pay slip so worth checking this in the appropriate month.

Standard hours

These are the hours you are contracted to work which are pensionable. For consultants this is a maximum of 10 PAs with anything extra up to 12 PAs is non-pensionable (www.bma.org.uk/media/3943/bma-model-contract-for-consultants-2020.pdf).

Basic pay

These are your pensionable hours which you have agreed to work subject to job planning. Any changes must be agreed by you and cannot be made by the trust unilaterally without discussion.

Additional Prog A NP

If you have agreed to regular additional sessions above the standard 10 PAs these will appear here. Usually most trusts will not agree to you working more than 12PAs.

Waiting list consult

If you have taken ad hoc additional sessions they should appear here. Some trusts record these on electronic rostering so you can check the agreed rate, hours and that they have been submitted to pay roll.

On call cat A Low Fr

Your on call category will depend on your job plan.

- Category A applies when the consultant is required to return immediately to site when called or has to undertake interventions with a similar level of complexity to those that would normally be carried out on site

- Category B applies when a consultant can typically respond by giving telephone advice and/or by returning to work later. They may on occasions need to return immediately to site (exception rather than the norm).

- High frequency is 1 in 1 to 1 in 4

- Medium frequency is 1 in 5 to 1 in 8

- Low frequency is 1 in 9 or less frequent

CEA/CIA

If you have clinical excellence awards or clinical impact awards, they will appear in this section together with the level, some are pensionable and newer ones are not.

NHS pension

If you make employee contributions to the NHS Pension Scheme (NHSPS) they will appear here. NHSPS employee contributions are tiered according to various income bands and the percentage contribution that you are making should also normally appear here.

Add year

If you have purchased additional years to your pension contributions these appear here.

ASP Alt Shared Payment

If your Trust has agreed an Alternative Shared Payment policy, which aims to 'recycle' employer NHS Pension contributions back to those employees who have opted out of the NHSPS, to reduce Annual and Lifetime Pensions Tax liabilities, then those payments will appear here (they are of course subject to NI & PAYE tax).

SD ref number

If you have a query with regards to your pension, this is the number they will ask you to quote.

What if I have a query?

If you are a member of the BMA they can help you with queries around your payslip, check you are being paid correctly and also give general advice on NHSPS issues.

As a general rule, it is good advice to all doctors that they should also check their annual Total Rewards Statement (TRS), which will summarise their total reward package and importantly their accrued pension service and projected benefits.

As advice on financial matters and especially on Pensions and potential Pensions Tax liabilities is so important, but also extremely complex, doctors should regularly use the services of both a qualified accountant and of an Independent Financial Advisor who specialises in advising doctors.

Additionally the NHS shared business services:

- The NHS SBS have a portal: https://nhssbs.microsoftcrmportals.com

- Or you can call them on 0303 123 1144 (Mon-Fri 8.00am to 5.00pm)

- In addition, NHS SBS also has app available which will give you mobile access to payslips - www.sbs.nhs.uk/es-MySBSPay - and allow you to view all elements of your pay, compare payslips, as well as have queries answered. If you have problems accessing the app please use the report a fault button. The app also offers access to a range of discounts from the high street and online retailers.